GMSQP Reference Manual

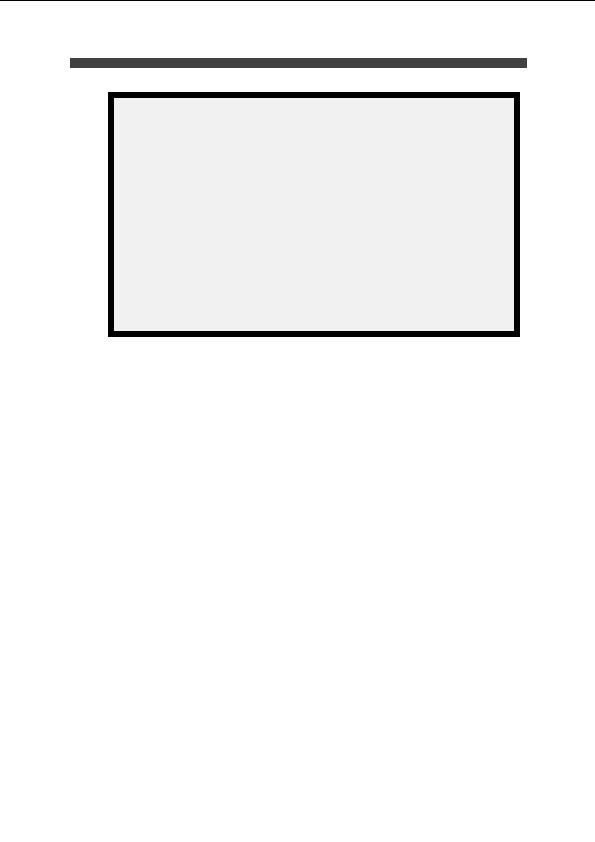

AS SCREEN

AS]Assistant Details Qualifier[*T278 ]

THIS ASSISTANT HAS NOT YET BEEN ATTACHED TO A GP < page

Dr R J TAYLOR, 45 Beech Avenue, Exeter

SUPERANNUATION DATA:

SD Number . . . [ ] Start Date | Supn Status = Non superannuable

|

NI Number . . . [ ] | Sup Employment Commenced [ ]

| " " Ceased. . [ ]

Date of Birth . 23.10.1967 [ ] V=Verified| "" Termination Code . . [ ]

|

Additional Voluntary Contributions: | Opt Employment Commenced [ ]

# per qtr % Start Date End date | " Ceased [ ]

# [ ] [ ][ ] |

# [ ] [ ][ ] | Extension of pensionable

# [ ] [ ][ ] | age until [ ]

# [ ] [ ][ ] |

# [ ] [ ][ ] | Terminal ADP sent to Sup.

# [ ] [ ][ ] | Division [ ]

# [ ] [ ][ ] |

Entry in # per qtr OR % only | 24 hr Retirement taken? [ ]

General notes:

[ ]

Figure 3: The AS Screen Page 2

Understanding the AS Screen Page 2

SD Number

The assistant's superannuation number. This is not mandatory, but if entered must be in

the format YY/999999, where YY is the year of the assistant s birth.

NI Number

The assistant's national insurance number. If entered must be in the format AA999999A

Date of Birth

The date of birth is taken from page 1.

Add Vol Contrib

.

Up to seven retirement contributions may be entered. The amount is deducted quarterly

between the dates for up to 10 years. The percentage will be deducted from all

superannuable payments made to the assistant, starting on his/her birthday, and normally

ending the day before his/her 60th or 65th birthday.

Sup Employ Comm.

The date superannuable employment started. Will default to the Start Date when the

assistant was registered with either a GP or a partnership. If an existing date is removed,

the assistant will be defined as non superannuable.

Crown Copyright

Version: 1.11

Section 1

5

5

footer

Our partners:

PHP: Hypertext Preprocessor Cheap Web Hosting

JSP Web Hosting

Ontario Web Hosting

Jsp Web Hosting

Cheapest Web Hosting

Java Hosting

Cheapest Hosting

Visionwebhosting.net Business web hosting division of Vision Web Hosting Inc.. All rights reserved